BUSINESS AT A GLANCE

Financial Services

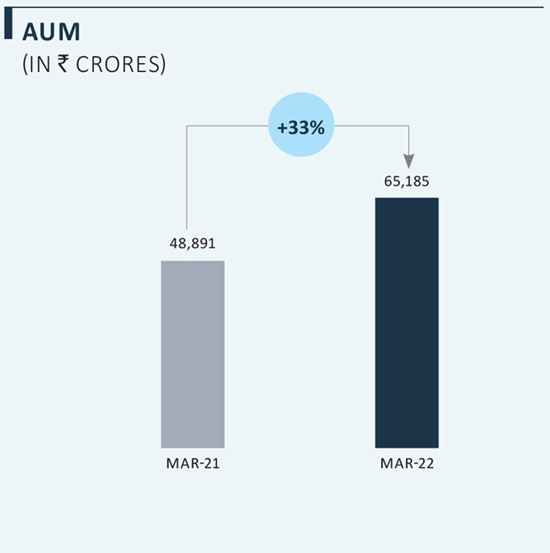

| Business Description | Loan Book / AUM | |

|---|---|---|

|

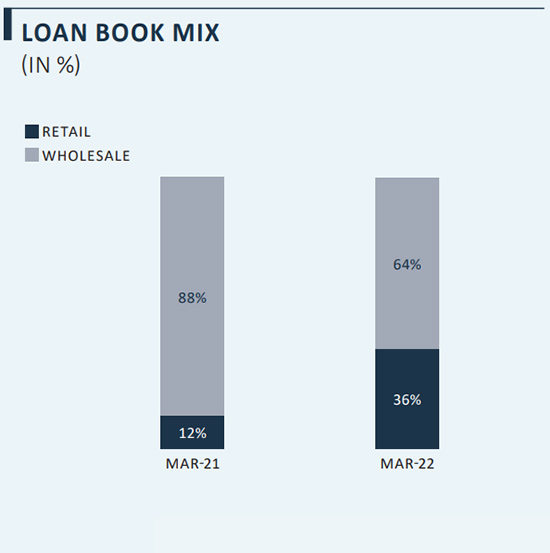

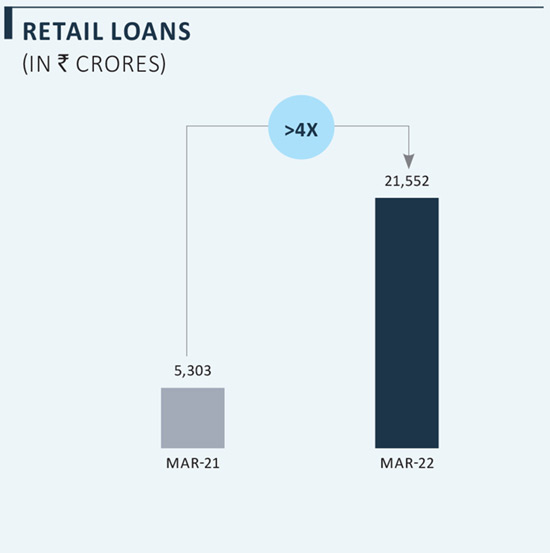

Retail LendingMulti-product retail lending platform, ‘digital-at-the-core’ DHFL acquisition significantly increased the size and scale of the retail lending business |

` 21,552 Crores1 |

|

Wholesale LendingLoans to residential & commercial real estate developers, as well as, corporates in select sectors |

` 43,633 Crores |

|

Alternative AUMFund management business; partnerships with marquee investors such as CDPQ and Bain Capital Credit |

~$ 1 Bn(Funds committed) |

|

Life InsuranceJV with Prudential International Insurance Holdings; industry leader in the Defense segment |

` 1,099 Crores(FY 2022 Gross written premium) |

|

Investments in Shriram20% stake in SCL2 |

` 5,095 Crores3 |

Notes:

(1) In addition, acquired ` 18,747 Crores of fee-earning, securitised assets (off-balance sheet) with DHFL, now managed by PEL

(2) SCL: Shriram Capital Limited and SCUF: Shriram City Union Finance

(3) Investments in SCUF based on market value; SCL based on book value, including accumulated profits

Pharma

| Business Description | FY 2022 Revenue | |

|---|---|---|

|

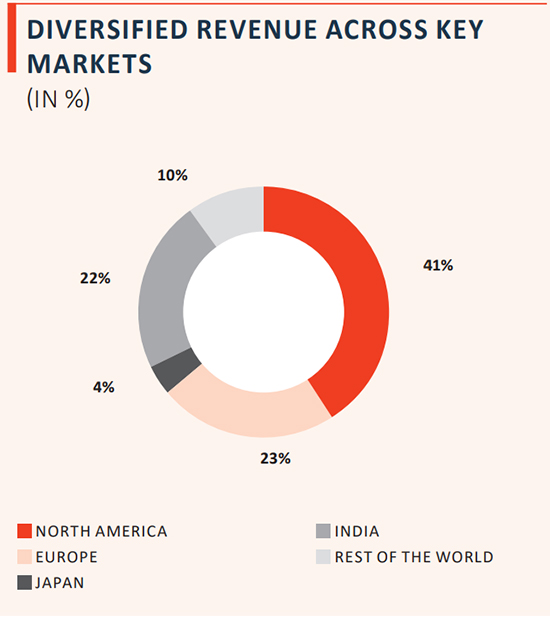

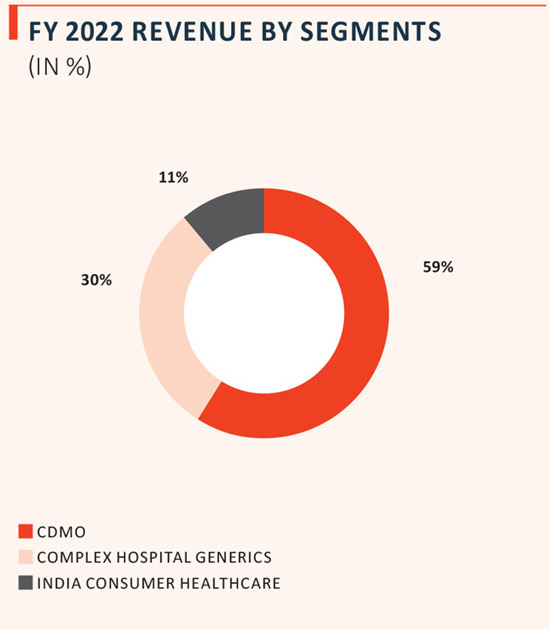

Contract Development and Manufacturing Organisation (CDMO)API and formulation manufacturing with a presence across the drug lifecycle, including research, development, clinical, and commercial manufacture. |

` 3,960 Crores |

|

Complex Hospital GenericsPortfolio of inhalation anaesthesia, injectable anaesthesia and pain management, injectable intrathecal treatment, and other injectables products sold across the globe. |

` 2,002 Crores |

|

India Consumer HealthcareIndia Consumer healthcare business in India with a portfolio of multiple brands in attractive segments and a nationwide sales & marketing infrastructure |

` 741 Crores |

|

JV with Allergan (49% stake)A market leader in the fastgrowing ophthalmology category in India, offering medications for diseases like glaucoma, dry eye, infections, and inflammations. |

` 414 Crores |