TECHNOLOGY & ANALYTICS

With two years of handling pandemic under their belts, technology’s strategic importance as a business transformer has evolved, rather than just being a commodity service provider or a strategic business partner. Digital adoption has taken a quantum leap encouraging us to undergo digital transformation and adopt to newer strategies and practices.

Technology & Digital

The Technology team at PEL continued its journey from being a Strategic Business Partner to co-own business outcome of tech led transformation with the business by:

- Maximizing productivity through automation

- Leveraging data to improve business operations and decision making

- Enhancing customer experience thro’ digital

- Cloud native IT infrastructure for improved security and flexibility

- Improved compliance and information security

Vision & Strategy

In line with the Company’s Technology Vision ASPIRE - ‘Aspire to be a Strategic Partner through Innovative solutions for Rapid Growth Enablement’ — the Technology team continues to transform the business through several technology & digital-led initiatives and programmes.

After having created a strong foothold in getting technology ready for business, PEL’s focus for this year has been to get business ready for technology. The Company continues to embrace the bi-modal technology approach of Strengthen the Core and Build for Future.

- Getting Technology-ready for Business: The technology team at PEL ensures that it has the right futuristic technology not just for essential day-to-day processes, but to also help the Company achieve growth, profitability, improve existing business processes and create newer business models.

- Getting Business-ready for Technology: As part of establishing technology culture in the organization, the Company ensures that the business teams embrace technology resources and capabilities to pivot, adapt and implement changes to reimagine the business and stay ahead of the curve in a highly competitive digital world.

Key Group Level Initiatives

Digital Centre of Excellence (CoE)

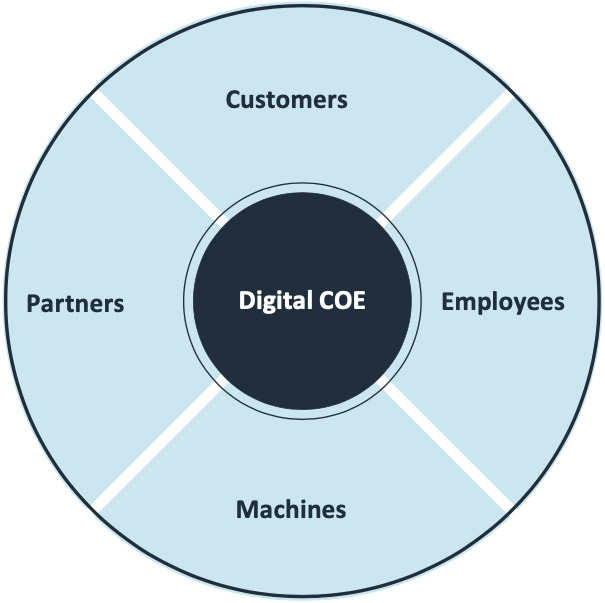

Established in FY 2019, the Digital CoE is at the core of the Company’s digital ecosystem which focuses on establishing newer ways of working, effectuate technology and enhance the business value of technology.

PEL leverages different technologies and processes, established under the Digital CoE, to benefit partners, customers, employees and machines. These include Robotic Process Automation (RPA) and Future-tech like multiple Low-Code/No-Code Platforms among others.

- Newer Ways of Working: Digital CoE serves as a centre of thought leadership and innovation for various technology specializations. In the pursuit to bring about a paradigm shift, the Technology team has been successful in establishing platform and product- based approach instead of traditional project-based approach. It has adopted AGILE methodologies, strengthened the culture of experimentation, leveraged start-up ecosystem and continuously improved end-user experience, as well as personalisation. Multiple initiatives and programmes organized during the year have proved vital to enable a cultural shift towards technology.

- Robotic Process Automation: RPA enables automating repeated manual processes and redeploying excess capacity. Large number of processes have been automated across various businesses and functions at PEL resulting in 41 FTE savings. We were also awarded UiPath Automation Excellence Award 2021 under Excellence in Customer-Process Automation.

- PEL has one of a kind automated testingin Pharma industry, which is compliant with FDA guidelines. It robotically generates, executes and maintains regression test records based on real- world use, automatically learning and substantiating system behaviour without user involvement.

- Future Tech: To do things in an innovative way, the Company is focussing on leveraging future-technologies like multiple Low- code/No-code platforms and tools to empower the business users build, maintain, upgrade and integrate digital assets without any formal knowledge of software development. An application to order food in office cafeteria is developed in-house, which led to reduction in food wastage or meal shortage by eliminating inaccurate meal requirement for the employees. An Idea Management Tool is also developed on the similar platform to gather all of our employees’ ideas and keep them in a single database, manage, evaluate, sort, process and execute. More than 30 such applications are being used across the organization built on the same platform.

The Digital CoE promotes an effective and efficient work environment, enhances communication with customers, collaborates with partners and facilitates strategic decision-making

Few initiatives by Digital CoE towards enhancing the business value are:

- Enhanced employee experience – Employee intranet portal has been migrated to a more experience focused, intuitive, scalable, collaborative, secure and customizable platform.

- Superior customer experience – A cloud-based supplier relationship portal was implemented to streamline the invoicing process in-turn reducing the cost of managing supplier invoices. The portal provides 24X7 secured access to up-to-date information and is synchronized with emerging regulatory requirements. Chatbot and WhatsApp for business were introduced to improve customer and stakeholder engagement.

- Partner ecosystem - The Company continues to focus on better communication and engagement with clients, increasing trust and building long-term customer relationships. Various customer facing and partner central apps have been launched for Business were introduced to streamline partner engagement process

- Machines – Smart meeting rooms have been established across offices and sites integrating hardware, software and collaboration tools in a meeting to create a seamless meeting experience for participants whether they are joining the meeting from office or remotely increasing the efficiency and productivity of employees in a hybrid working scenario.

Focus on Continuous Learning

The IT Academy is an integrated platform that addresses gaps in individual technology capabilities and expands domain knowledge by providing access to a multitude of learnings. It focuses on role based and skill based learning journeys of all technology employees globally and keeps him/her ahead of the curve. In total, 4 role-based skill development journeys in fields of Process Automation, Analytics, information security and other cutting-edge applications & tools were conducted in FY 2022 to enable employees leverage newer technologies better and faster. 153 employees from various business units of the organization across the globe became a part of these learning journeys.

Information and Security Compliance

- Strengthening of Information Security Policies and procedures and keeping them current and relevant has been part of the Information Security culture.

- PEL believes that Information and Security is the responsibility of everyone and runs many initiatives for Information and Cyber security awareness. To ensure all Piramal employees are aware Information security, cyber security latest trends and issues, every employee is mandated to undergo a mandatory gamified online training program on cybersecurity awareness. Piramal Information Security conducted Phishing assessment and Cyber Quiz to check employee awareness and also continued to send periodic awareness emails, newsletters, and posters.

- PEL Information Security team continued its journey of modernising its information and cyber security tools and solutions to protect the organisation against various cyber-attacks and threats and minimise the damage in case of such attacks.

Financial Services

Retail and Wholesale Finance IT continue to move forward on the digitization journey. Retail finance continued to scale the core Loan Origination Platform for new product lines (Used Car Loans, Unsecured Business Loans), and across all erstwhile DHFL branches. We have also set up an in-house software development team in Bengaluru to build digital products that help serve our customers. Key initiatives include:

- Launched customer apps on android and iOS. Customers can now access their loan statements, and avail cross-sell offers through this app. More than 125k customers have downloaded the app

- Launched a generic API stack for Embedded Finance partners to offer our loans to their customers.

- Launched Partner Central, a central place for our sales partners (Connectors, DSAs) to engage with us. Sign-up process for our sales partners is now entire digital and process TAT has reduced from 4+ days to an average of 12 mins.

- Launched Parichay, our KYC platform, that combines various types of KYC into a single KYC journey for our customers with minimal friction

- Launched Policy Engine, a platform that allows us to integrate new data sources and code new policies very easily

Wholesale Finance IT upscaled and integrated multi-cloud platform, with prime focus on digitizing the complete loan lifecycle as well as data, leveraging latest technologies in agile manner. With external fintech integrations, we have created a robust analytical framework which can be leveraged to build the next generation analytics.

Pharma

Project Catalyst

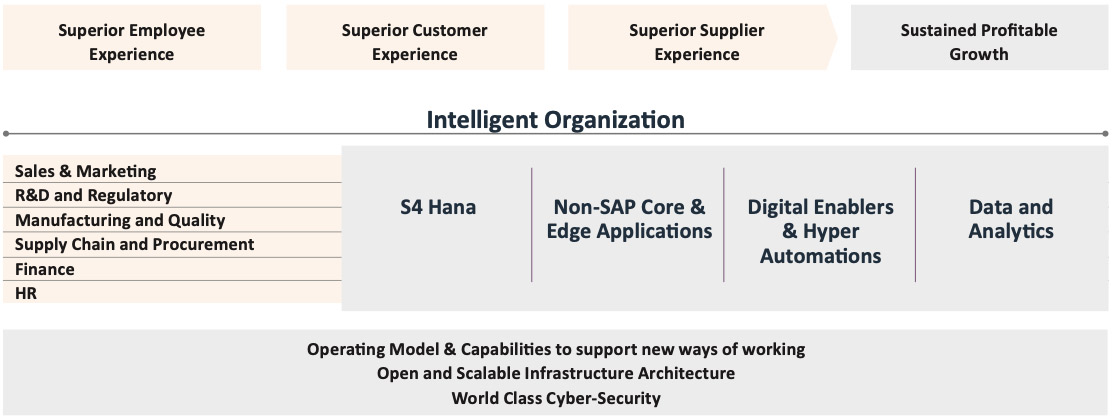

As we grow and scale our Pharma businesses, we anticipated opportunities in our current technology aligning to evolving business vision and strategies. To enhance PPL’s profitable growth momentum and create a future ready organization, we embarked on a Digital Transformation Journey – Project Catalyst. Our intent behind undertaking the project is to deploy technology as a catalyst with a vision to sustain profitable growth by enhancing customer experience, frictionless supplier collaboration, and highly productive and efficient workforce. The objective is to build an intelligent organization by leveraging digital ERP at the core complemented by innovative Edge applications, Hyper-automation, and Data analytics.

We carried out the strategy phase of this journey to draw a tech enabled 3-year digital transformation roadmap consisting of more than 50 initiatives covering enterprise-wide processes, technologies, and people across all the PPL entities.

Project Catalyst is expected to bring a significant shift in our ways of working by moving from manual processes to embedding technology and digital across processes to achieve better business outcomes more effectively and efficiently.

Technology @ Piramal Pharma

Piramal Pharma is leading the pack in the age of digital transformation. Our Digital, Quality, and Infrastructure teams have paced up their efforts to become a strategic business partner by harnessing new technologies and delivering immense value to our business. Technology strategy continues to support the business strategy by focussing on customer, quality, workforce, and capabilities in the following areas

Expanding the Tech blue-print: We have been expanding our tech blue-print to the newly acquired sites, namely, Sellersville (US), Turbhe (India) etc. Various tools and products on Quality, EHS, IT Infrastructure, Security, and ERP have been deployed or are planned to be deployed to improve productivity, efficiency, and compliance at the sites.

We have also implemented Manufacturing Execution System (MES) at one of the sites to electronically control, monitor, and document the manufacturing processes digitally in real-time through the entire manufacturing cycle to batch release. We are progressing on our cloud native IT infrastructure to be more efficient, strong, and secure with prime focus on business agility, automation, and better user experience.

Data-Driven Culture: Data Analytics continues strong collaboration with strategic Business functions so that critical decisions are based on data driven insights. This initiative has helped automate several business KPIs across the value chain improving efficiency and accuracy, allowing faster decision-making, streamlining business processes, and help increase productivity. Various salesforce automation and reporting tools have been implemented for both B2B and B2C markets to enhance cross communication and visibility within the sales team, improved lead generations and product visibility tracking in turn improving the success rate of converting leads to opportunities.

Enhanced Customer Experience: The online traffic to our websites has increased to 50,000+ views since we launched Digital Walkthrough of sites using 3D virtual reality tool during pandemic

Exceptional Employee Experience: PIRO Chatbot was launched in India last year to address employee related queries improving HR process efficiency. It has been successfully adopted and embraced by the employees. It acts as a central tool for employees to access policy-related information. Since launch, more than 50,000+ queries have been raised and addressed with 98% accuracy.

Be Safe@Work: As an organization, we are fully committed to achieving excellence in Environment, Health, and Safety (EHS). IT collaborated with EHS to launch a completely digitized solution globally, MySafe App for automating manual EHS activities such as Incident tracking, inspections and observations, CAPA management and monthly performance reporting. This has enabled Single Source of Truth across all manufacturing sites and help take corrective actions for Employee Safety.

Digital Simplification: Successful deployment of AI-powered, Capex Bot across various manufacturing sites has simplified the capital expenditure approval process, thereby reducing the average lead time by 72%. We have leveraged RPA to automate Amazon Ads report for Consumer Products Division, to help business to take faster decision with accurate data saving almost 650 man-days per year.

Analytics

Today, companies have more data, and more ways to use it, than ever before. In the right environment, with the right enablers, data and analytics drive growth. One of the most potent forms of analytics is Artificial Intelligence (AI). By helping companies detect, and even anticipate, behaviour and patterns, AI has transformed areas like customer service, retail analytics, and industrial automation. It enables faster, better decision making and can result in massive competitive advantage.

PEL’s presence in its two core businesses – Financial Services and Pharma – gives the Company access to a significant amount of data. Financial institutions have deployed analytics and data-driven capabilities to increase growth and profitability, to lower costs and improve efficiencies, to drive digital transformation, and to support risk and regulatory compliance priorities. Pharma companies too, have been amassing an enormous amount of data pertaining to sales, operations, research & development and patient behaviour to manage costs and risks, while providing quality services to their clients.

At PEL, key decision-makers across the organization leverage analytics to gain data-driven actionable insights and have embedded this approach in day-to-day processes. The Company has developed tools with diverse applicability and replicability across both the Financial Services and Pharma businesses.

As data-driven decision making becomes an essential part of PEL’s everyday operations, it is strongly pursuing technology-enabled opportunities and adapting contemporary best practices to deliver exceptional business value.

Financial Services

In the Financial Services business, primarily Retail Lending, we are extensively using AI/ML, Decision Sciences and automated Business Intelligence (BI) in every aspect of the business. With the help of these modular next-gen capabilities, enabled by the India stack, we have leveraged AI/ML and Decision Science to re-imagine the entire customer journey. We have implemented real-time AI/ML models in critical path of business decision-making in key areas such as sourcing, credit, fraud, cross-sell, attrition, collection buckets, NPA addition and recovery management.

- Credit Rule Engine for new customer onboarding: Credit Analytics Rule Engine (CARE) is based on a ML algorithm to predict the probability of a customer becoming delinquent in future. It considers demographic, bureau, bank statement, GST and property details (in case of secured loans). It also enables risk-based pricing based on ‘CARE grids’ along with other important parameters.

- New-to-credit (NTC) Credit underwriting ML model: Multiple alternate data-based ensemble ML model to predict the probability of future delinquency for NTC customers.

- Fraud detection and loan application screening: Fraud Analytics Rule Engine (FARE), based on ML algorithm, helps identify fraudulent applications, thereby minimizing the false positives. We have also partnered with third-party fraud detection service providers, including alternate data to identify known frauds.

- Portfolio Risk Management / Monitoring: We conduct a comprehensive early/coincidental risk-tracking for the overall portfolio, across multiple dimensions, to identify improvement areas. This is achieved via an algorithm-based automatic identification of “High Risk” segments (or ‘Outliers’) to take appropriate risk actions.

- Cross-sell Management: A ML-based algorithm is used to identify existing customers with a lower probability of default in near future. Further, we use a valuation-based algorithm to identify appropriate product/pricing for cross-sell.

- Attrition Management: We use AI/ML models to predict underling risk of customers’ account and probability of foreclosure. Based on the output of these models, we provide differentiated best offers to customers to optimize expected value.

- Collection and NPA Management: We have developed a ML-based algorithm to identify the probability of payment by delinquent customers and create collection queues for effective treatments/ tools. We also have a ML model for recovery from GNPA pool for collection prioritization and actions.

- Everyday AI: We are solving day-to-day business problems like CKYC (Central Know Your Customer) drop-offs from digital journey, credit scoring based on images of houses / livestock for MFI (micro- finance) business, model for video on personal discussion through AI/ML algorithms etc.

DHFL Acquisition - Developed proprietary AI/ML models to predict default risk in the acquired portfolio

At the time of acquisition, we had developed proprietary AI/ML models to predict the default risk in DHFL’s retail portfolio. The models used 52 inputs across customer risk, collateral risk and demographics and estimated the defaults over the next 12 months. The output of these models was factored into the deal valuation. The asset quality of the DHFL retail portfolio remains in line with expectations. The incremental NPA formation has largely been from the ‘high risk’ segment as predicted by ML-models. Furthermore, the model efficacy was well-tested during the COVID 2nd wave.

We have built a best-in-class data science team with top talents from leading technology institutions and are working on cutting-edge data science workbench hosted on cloud. We have set-up a Digital Center of Excellence (CoE) in Bangalore and hired ~400 employees in the technology & analytics team.

We continuously monitor the ML models to effectively drive analytics driven business decisions. For seamless decision-making, we have integrated our in-house application/loan management systems with cloud, multi-bureau, third party KYC/AML/Fraud/credit service providers and lending partners using Application Programming Interface (API). We continue to leverage various external partner integrations, thus, creating a unique customer experience.

Leveraging Data Science / AI in the Retail Lending business:

AI/ML Risk Models for Acquisition

70,000

Applications processed

` 2,600 Cr

Disbursed

AI/ML Models for NPA Recovery

30,000

Customers queued

` 573 Cr

Collected

AI/ML models for Retentiony

19,000

Cases processed

` 325 Cr

Retained

Database program (Samman)

` 80 Cr

Loans

disbursed

Real-time visualization dashboard

80 +

KPIs tracked

- Real-time

- Deep drill-down functionality

- One information platform for entire company

Data Self-Service Platform

20 +

Use cases

live

Model Governance & Monitoring

- PSI/CSI

- Gini/AUC

Modern Data Platform: Snowflake

- Sagemaker

- Streaming Data

- Data Governance

Risk Monitoring Platform

- Early warning

- Bounce

- Delinquency

- NPA

* Numbers correspond to FY 2022

PSI: Population Stability Index

CSI: Characteristic Stability Index

AUC: Area Under the Curve

Pharma

Global Pharma Business

In the Global Pharma Business, analytics is one of the key initiatives. During the last year, multiple analytics use-cases were developed, which were mostly descriptive, diagnostics in nature and few were for predictive modelling. The analytics use-cases and KPIs are mostly a part of Finance, Quality, Supply Chain, Manufacturing, Customer Centricity, EHS and others.

Sustainability, robust data and best-in-class user experience empowers ourpersonnelacrosssiteswithinsightfulinformationonmultipleKPIs that play a major factor in to improve performance, productivity and data-drivendecisionmaking.

India Consumer Healthcare

Use of data analytics has been instrumental in the identification of the following goals for the Consumer Healthcare Division:

- Identification of high growth areas, data driven incentive program for the sales force and setting machine learning enabled credit limits for distributors based on key parameters such as business relevance, risk etc.

- Pre-emptive employee retention model allowing the HR function to identify potential attritions through machine learning and proactively take mitigating measures for high performing employees

- Development of a ‘smart bidding’ search marketing algorithm (for online/web search) to optimise the e-commerce marketing mix for the entire portfolio.ew

- The algorithm leverages Natural Language Processing (NLP) to increase sales at a lower cost of acquisition.

- Incorporation of frameworks to understand the end customer, competition and return on investment.

- The framework has led many of Consumer Health care brands to become market leaders on e-commerce platforms across multiple categories.