Download

Intent to Impact

Piramal Enterprises at a Glance

Key Milestones of our 14-year Financial Services Journey

An Esteemed and Diverse Board

Well-Experienced Management Team

Performance Excellence Along With Business Transformation

Message From The Chairman

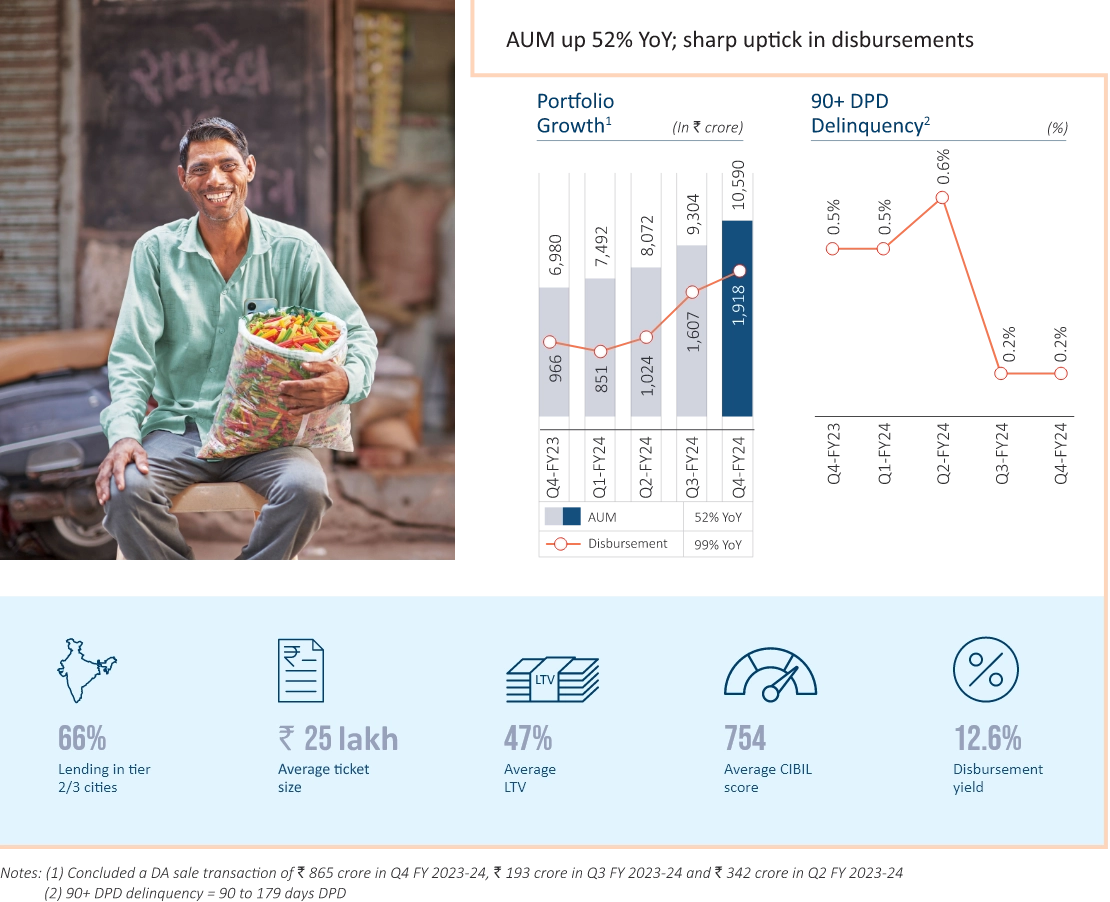

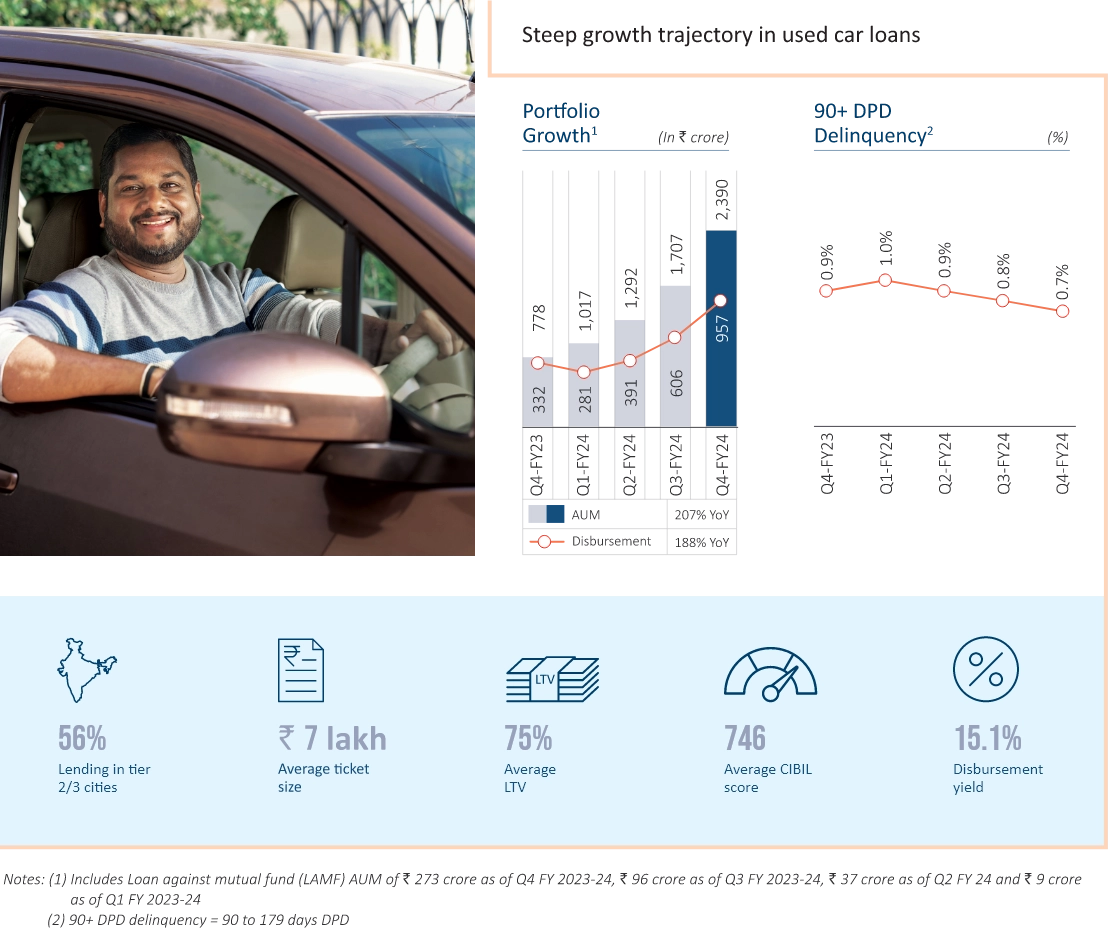

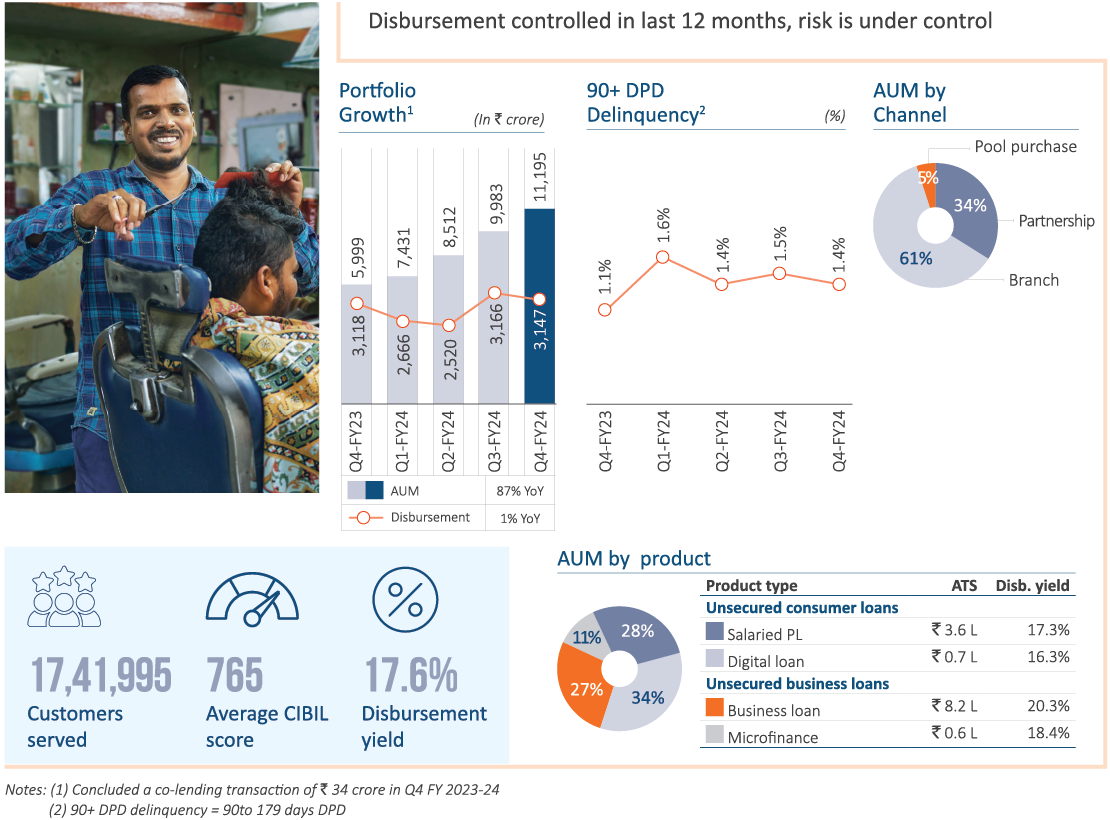

Operational and Financial Highlights

Our Business Segments

Technology: Making The Right Investments and Aiming for Future Growth

Branding: Decoding Our Equity and Evaluating Performance

Human Capital: Nurturing a Culture of Trust for Employee Success

Risk Management: Building Resilience. Safeguarding The Business

Awards & Recognition

Board of Directors

Management Team

.webp)