NBFC liquidity

tightening

How did the NBFC sector get impacted?

Post the defaults by a large entity, liquidity tightened for the NBFC sector

- A large number of HFCs / NBFCs were not getting enough liquidity

- MFs reduced their exposure to NBFCs / HFCs by nearly ~`67,000 Crores between September 2018 and April 2019

NBFCs / HFCs witnessed a slowdown in loan disbursements

- The combined loan book growth of NBFCs and HFCs slowed down significantly in Q3 and Q4 FY2019 to 18% y-o-y and 13% y-o-y respectively, from ~23% in H1 20191

- HFCs’ monthly average disbursement fell to `13,500 Crores post September 2018, as compared to `25,000 Crores per month in the past four quarters2

Few NBFCs / HFCs also resorted to portfolio sell downs

- Few players, who were not getting enough liquidity, had to resort to portfolio sell-downs, which resulted in subdued performance of the overall sector

Notes: 1. Credit Suisse

2. India Ratings

How did PEL perform?

Raised long-term funds amounting to nearly `16,500 Crores in H2 FY2019, which is equivalent to 30% of loan book size

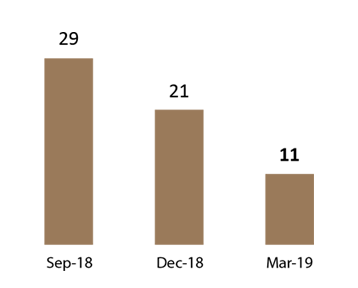

Reduced commercial paper (CP) exposure to `8,900 Crores as on March 31, 2019 from `18,000 Crores in September 2019

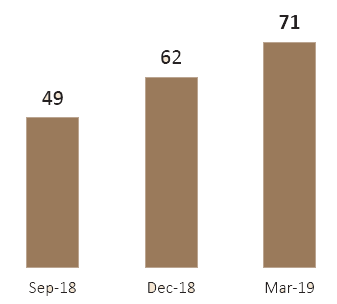

Significant increase in the share of bank loans in the overall borrowing mix

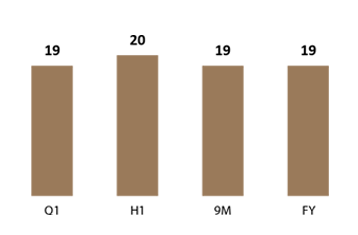

Share of bank borrowings in

overall borrowings1

(%)

Share of mutual funds in

overall borrowings1

(%)

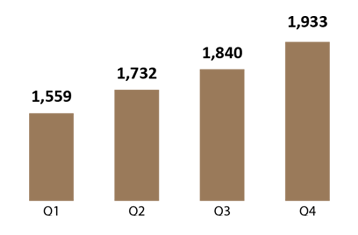

Consistent quarterly performance, with improving revenues and steady

profitability throughout the year,

despite system-wide liquidity tightening

Financial Services Revenues (FY2019)

(` Crores)

Note: 1. Data for PCHFL

2. Considering Cash Tax and other synergies from merger

Financial Services ROE2 (FY2019)

(%)