Pricing Pressures

in Pharma

How were the pharma players impacted?

Buyer’s consolidation has impacted the regular generics businesses

- Consolidation and integration of purchasing organisations has adversely affected pharmaceutical manufacturers and increased the product pricing pressures

- Most peers are increasingly realising the importance of establishing presence in Specialty Pharma therapies

- Buyer consolidation in the US has left just three distributors controlling 85% of the market1

Faster drug approvals have kept up pricing pressure for pharma firms

- The faster pace of ANDA approvals by USFDA has increased competitive intensity thereby impacting generic prices

- Record 781 ANDA approvals were granted by the USFDA in FY2018, as against 763 approvals in FY20172

Regulators are becoming ever-more stringent with increased scrutiny on pricing actions

- Several regulators have started to benchmark pricing across countries and regions

- Regulators are also controlling the prices of pharmaceutical drugs in India

Notes:

- Edelweiss

- USFDA data

How did PEL perform?

PEL had strategically chosen to stay ahead of the curve and expanded into niche specialty businesses

- In 2010, The Company sold the India Formulations business to Abbott at a record 30x EBITDA, as the company could sense the impending pricing pressure impacting the domestic pharma business.

- It focused on niche areas of CMO and complex generics while most Indian pharma peers have been focusing on competitive large volume generics business

Hence, PEL’s Pharma business delivered consistent performance, with improving revenues and steady profitability

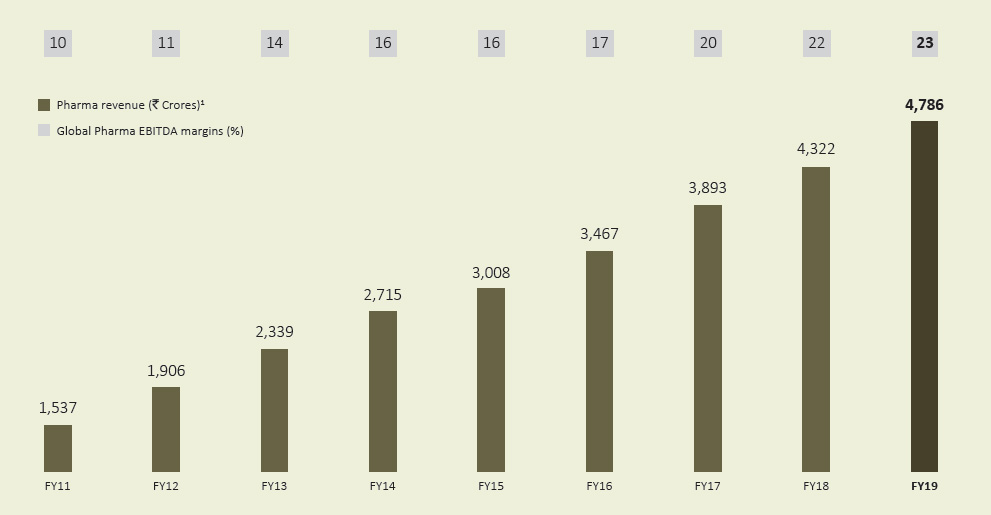

- PEL’s Pharma revenue has consistently grown at a CAGR of 15% over last 8 years

- Global Pharma has a strong presence in regulated markets

- Global Pharma EBITDA margin increased from 10% in FY2011 to 23% in FY2019

Significant improvement in Global Pharma EBITDA over the last few years

Note: 1. Pharma revenues include Global Pharma and India Consumer Products